Banking & Finance

Vietnam banking sector shows positive outlook for 2025: VinaCapital

Published

1 year agoon

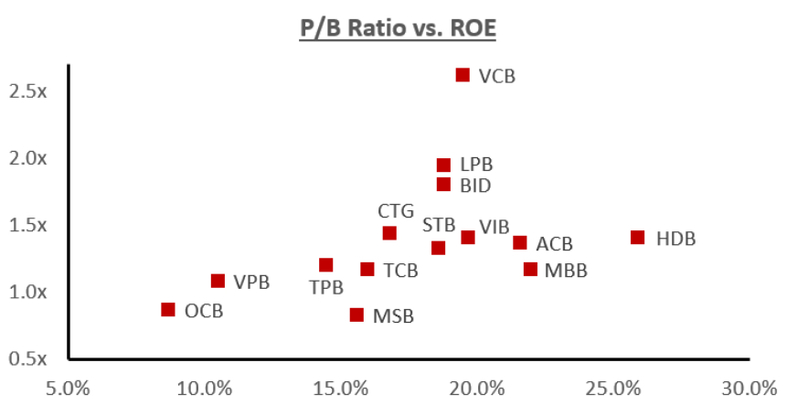

Vietnamese bank stocks significantly outperformed the VN-Index in 2024, and strong performance is expected this year, given the low valuation of bank stocks (1.3x P/B vs 16% ROE), write chief economist Michael Kokalari and senior bank analyst Thuy Anh Nguyen at VinaCapital.

Michael Kokalari, chief economist of VinaCapital. Photo courtesy of the company.

Bank stocks account for 40% of the VN-Index and vastly outperformed the benchmark index in 2024. The 18 banks listed on the Ho Chi Minh Stock Exchange surged 26% in VND terms vs 12% for the VN-Index.

We believe the sector will deliver a strong performance again this year, partly because we expect sector-wide bank earnings growth to accelerate from 14% in 2024 to 17% in 2025, as the main drivers of Vietnam’s GDP growth shift from exports and tourism in 2024 to consumption, infrastructure spending, and real estate in 2025.

Earnings growth acceleration, coupled with attractive valuations (1.3x P/B versus 16% ROE), should drive further stock price appreciation.

The performance of individual bank stocks in Vietnam varies considerably, creating ample opportunities for active managers to outperform the broader stock market. The wide range of stock price performance reflects the widely varying business strategies, risk profiles, and valuations of banks in Vietnam.

We discuss the current thinking of VinaCapital’s portfolio managers and research team on bank stock selection below, as well as how our outlook for Vietnam’s economy, which was discussed in our Looking Ahead at 2025 report, informs our current stock picking strategy.

Bank Performance and Weight Data (2024)

| Bank Name | Performance (2024%) | Weight (%) |

|---|---|---|

| Lien Viet Post Bank (LPB) | 132% | 1.8% |

| Techcombank (TCB) | 55% | 3.5% |

| HD Bank (HDB) | 51% | 1.7% |

| Vietinbank (CTG) | 39% | 4.0% |

| MB Bank (MBB) | 35% | 2.6% |

| Sacombank (STB) | 32% | 1.3% |

| Nam A Bank (NAB) | 30% | 0.5% |

| Asia Commercial Bank (ACB) | 24% | 2.3% |

| VIB Bank (VIB) | 17% | 1.2% |

| Maritime Bank (MSB) | 16% | 0.6% |

| TP Bank (TPB) | 15% | 0.9% |

| Vietcombank (VCB) | 14% | 10.7% |

| Eximbank (EIB) | 12% | 0.7% |

| BIDV (BID) | 5% | 5.5% |

| OCB Bank (OCB) | 3% | 0.5% |

| VP Bank (VPB) | 0% | 3.1% |

| SHB Bank (SHB) | -5% | 0.8% |

| Sea Bank (SSB) | -20% | 1.0% |

In short, we expect Vietnam’s export growth to the U.S. to plunge this year, which should be offset by increases in infrastructure spending, real estate development activity, and consumer spending.

Slower export growth will weigh on GDP growth because exports are nearly 100%/GDP, but most of Vietnam’s exports are produced by FDI companies that are not reliant on local banks for financing; while slower exports will affect the economy, they will not significantly hurt the banks.

Furthermore, banks should be the biggest beneficiaries of the shift to more domestically driven growth because Vietnamese banks touch nearly every part of the country’s domestic economy, and banks are especially exposed to real estate and consumption, which we expect will help drive the economy in 2025.

We expect the Government will take concrete steps to boost the real estate market this year, which could result in mortgage loan growth doubling from around 10% in 2024 to 20% in 2025.

A real estate market revival would also boost consumer confidence, as well as other forms of high margin consumer lending, such as auto loans and buy-now-pay-later purchases.

Consumer confidence in Vietnam was very weak throughout 2023 and in the beginning of 2024 but began recovering from mid-2024. A real estate market revival would further boost confidence and lending to consumers.

The Government also plans to support 2025 GDP growth by spending more on infrastructure development, which should create more lending opportunities for banks. That said, the most important takeaway from all of the above is that the combination of increased infrastructure spending, improved consumer sentiment, and a real estate market revival would all propel banks’ credit growth, support banks’ NIMs, and foster the ongoing recover of asset quality in Vietnam.

Recovering asset quality & improving loan mix

We expect the earnings of Vietnam’s listed bank shares to grow 17% this year, driven by 15% system-wide credit growth and by a slight increase in system-wide NIM (by 6 bps to 355 bps in 2025). The ongoing recovery in asset quality will also support earnings growth somewhat this year, as will an improved composition of loan growth.

We discuss both of those topics below, as well as interdependencies between loan growth, NIM, and asset quality. For example, weak demand for mortgages in 2024 prompted banks to grow their business lending by nearly 20% last year, but much of that new lending was short-dated working capital loans, lent at highly competitive interest rates, which in-turn depressed NIMs.

We expect Vietnam’s system-wide loan growth to remain at around 15% in 2025 but for high-margin retail loan growth to accelerate from around 12% in 2024 to 15% in 2025. We also expect banks to make more long-dated loans this year by lending to infrastructure projects, which typically have long time horizons.

The resulting “maturity transformation” associated with those new long-dated loans will support NIMs (banks earn higher profits by gathering short term deposits and extending long-term loans that usually earn higher interest rates).

That said, some banks extending long term loans will also need to raise additional long-term deposits/funding to fund that lending, which will temper the profitability of those loans. Finally, real estate lending picked up considerably last year as the market recovery gathered steam, although some lending to real estate developers was for the refinancing of maturing corporate bonds that developers previously sold to retail and other investors.

Mixed NIM dynamics

We expect system-wide NIM to tick-up slightly in 2025. Consumer and infrastructure lending should boost NIMs, and the real estate market rebound means that banks will not need to roll-over loans to problematic borrowers at low interest rates in order to “rescue” their customers.

Also, some banks extend “window dressing” loans with de minimis NIMs to reach their credit quotas when credit demand is low – in order to ensure being granted comparable credit quotas by the SBV the following year. Such lending depresses reported NIMs, but banks should be able to meet their credit growth quotas with real loan demand this year, which in-turn should alleviate this source of downward NIM pressure in 2025.

All of that said, system-wide loan growth in Vietnam outstripped deposit growth by 4% pts as of end-September (9% year-to-date loan growth versus 5% year-to-date deposit growth), which is putting upward pressure on deposit rates.

We would characterize the current state of system-wide liquidity in Vietnam as “tight, but not stretched.” That characterization is consistent with the fact that six-month deposit rates initially fell by about 60 bps in early-2024 (reaching a low of 3.5% in March), and then bounced back to over 4% by end-2024.

Note that: 1) The VND depreciation (5% in 2024) is also currently putting upward pressure on deposit rates, and 2) inflation averaged 3.6% in 2024 and is not significantly impacting deposit rates.

In short, we expect the average six-month deposit rates of all Vietnam’s banks to increase by 50-70 bps this year to nearly 5% by end-2025 (note that state-owned banks typically pay savers interest rates that are typically around 1% pts below the average rates private sector banks pay). That modest increase in deposit rates, coupled with all of the factors discussed above, means NIMs are likely to finish this year nearly unchanged.

Recovering asset quality

Asset quality issues in Vietnam reached a crescendo in early-2023, following the collapse of Saigon Commercial Bank (SCB) in late-2022. The official, system-wide NPL figure has hovered around 2% since then, thanks in part to various forbearance measures, although the official number looks set to start declining despite the fact that most of those measures have now expired.

More importantly, some banks started reporting “Other Income” from the recovery of bad loans that had already been written off. This so-called “write-back” income is a concrete sign that banks asset problems are now essentially finished, and it boosted sector-wide earnings by about 10% pts in 2024.

Write-backs are recorded as Non-Interest Income (NOII), which in-turn accounts for about 20% of the Total Operating Income (TOI) of Vietnamese banks. We expect NOII to grow by over 10% this year, driven by write-backs and by other non-interest income such as bancassurance fees.

However, credit costs are only likely to drop slightly (from 1.2% in 2024 to 1.3% in 2025), despite recovering asset quality. This is because the average Loan Loss Reserve in Vietnam fell from well over 150% two years ago to around 100% on average now (the median LLR is around 70% and some banks’ LLRs are well below 100%).

In short, banks in Vietnam were essentially over-provisioned in the lead-up to the SCB collapse, and then depleted their LLRs during 2023-24 to manage their reported earnings. Vietnamese banks have now started rebuilding their LLRs, which is why we do not expect a bigger drop in credit costs this year, despite improving asset quality.

Picking the winners

Vietnamese bank stocks are trading at a 1.3x FY25 P/B versus 16% expected ROE, which is ~2 standard deviations below banks’ 5-year average P/B (banks that generate 16% ROE typically trade above 2x P/B).

Valuation is also cheap on a Price Earnings Ratio basis at 0.5x PEG (8x FY25 P/E vs. 17% EPS growth). Last year, valuations were even cheaper before a partial re-rating of bank stock valuations, when the increase in bank stock prices (26%) outpaced EPS growth (14%).

One reason for that cheap valuation is that Vietnam’s 30% foreign ownership limit (FOL) for banks essentially makes local retail investors the marginal buyers who set bank stock prices in Vietnam, and those investors are not as focused on valuations as foreigners.

Investors in Vietnam’s stock market are generally aware of the sector’s inexpensive valuation, but many do not realize how big the divergence is between the valuations and stock price performance of individual banks, or how much divergence there is between the operating, asset quality, and other metrics among individual banks.

These all factor into how we select the bank stocks for our diversified portfolios, as does our expectation for a shift to more domestically driven growth this year that would benefit banks focusing on the real estate sector and lending to consumers, as well as banks that lend to infrastructure projects (the latter are likely to be state-owned banks).

We bifurcate those banks into two groups: banks with good asset quality and more diversified loans/less exposure to the real estate sector, and banks with higher exposure to the real estate sector and/or that are more aggressively geared to a recovery of consumer borrowing. We then carefully consider valuation metrics to make our actual stock picks given the wide variation as can be seen in the chart below.

The former cohort includes tickers like ACB, VCB, CTG, BID, STB, and VIB, which are all banks that have the capacity to benefit from the “rising tide lifting all boats” dynamic that we expect for Vietnam’s banks this year.

Those banks are especially able to expand their lending to the real estate sector since they are not encumbered by legacy issues and/or the need to support their distressed customers. These are also the banks benefitting the most from write-back income because their prior prudent lending practices mean that they have more recoverable collateral assets backing their loans.

The latter cohort includes more aggressive banks like TCB, VPB, MBB, and HDB, which may either directly benefit by increasing lending to real estate developers or will likely see some of their legacy asset quality issues resolved by a revival of the real estate market.

For example, we mentioned above that the LLRs of some banks are well below 100%; the stock prices of thinly provisioned banks (or banks that the market believes have underreported their bad debts) should be highly geared to a recovery in the real estate market.

A strategy for 2025

The portfolios of our active investment funds include both “fast mover” banks that are highly geared to Vietnam’s likely economic scenario this year, plus some more conservative banks that are unencumbered with legacy issues.

We think of this as a “barbell” bank investment strategy and also overlay bank-specific considerations into our investment decisions, such as picking banks that have recently resolved (or are likely to soon resolve) legacy issues, banks with particularly strong digitization plans, and/or banks that can (and will) raise substantial amounts of capital in order to fund their growth going forward.

Conclusions

Bank stocks significantly outperformed the VN-Index in 2024, and we expect strong performance this year, given the low valuation of bank stocks (1.3x P/B vs 16% ROE). That said, there is a wide dispersion between the valuations, asset quality, and earnings growth drivers of listed banks, giving active fund managers ample opportunities to outperform that market.

Finally, we expect sector-wide earnings growth to pick up this year, driven by a shift in Vietnam’s GDP growth drivers from external factors in 2024 to domestic driven growth in 2025.

You may like

-

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

-

Uncertainty weighing on real estate

-

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone

-

Green engagement rides high in Vietnam

-

New standards being reached within green industrial parks

-

Vietnam PM asks Warburg Pincus to invest ‘further and faster’

Banking & Finance

VN-Index to hit 1,450 points in H2: broker

Published

1 year agoon

February 11, 2025Companies listed on the Ho Chi Minh City Stock Exchange (HoSE) are projected to see an average 18-20% profit growth in 2025, and its benchmark index, the VN-Index, will reach approximately 1,450 points in the second half, according to Agribank Securities (Agriseco).

Vietnam is currently one of the stock markets with the lowest P/E ratio in the region. Photo by The Investor/Trong Hieu.

Last Friday, the last trading day before the Lunar New Year holiday, the VN-Index rose over 5 points to 1,265.

According to Agriseco, the index is currently trading at a price-to-earnings (P/E) ratio of around 13 times and a price-to-book (P/B) ratio of 1.7 times, both of which are below the market’s five-year averages of 14.5 times and 2.0 times, respectively. Notably, the P/B ratio is at its lowest level in the past five years.

Given the current P/E ratio, Agriseco believes that the VN-Index is one of the most undervalued markets in the region. Additionally, Vietnam’s market shows a higher return on equity (RoE) compared to the regional average, indicating that Vietnam’s stock market is relatively attractively valued.

Agriseco is optimistic about the market’s prospects for 2025, with strong economic growth and robust corporate earnings expected to drive performance. Furthermore, the anticipated upgrade by FTSE Russell from a frontier market to an emerging in 2025 is likely to attract both foreign and domestic investors.

The market is expected to see an influx of $5-6 billion from exchange-traded funds (ETFs) tracking FTSE indices and active funds then. Such an event will likely increase the number of foreign investors in Vietnam, benefiting securities firms such as Saigon Securities (SSI), Ho Chi Minh City Securities (HCM), and Viet Capital Securities (VCI), which manage a significant portion of foreign accounts.

Large-cap stocks such as Vietcombank (VCB), Vinhomes (VHM), FPT, and Hoa Phat Group (HPG) are expected to be in focus as foreign capital flows into the market.

Stock opportunities

Agriseco highlights real estate as a potential opportunity. Currently, the real estate sector is trading at a P/B ratio of 1.2x, which is lower than the five-year average of 2.4x. Since the beginning of 2024, the group has lagged behind the VN-Index, with prices continuing to decline.

The most significant declines have been seen in small-cap stocks with poor earnings and high leverage. However, companies with strong land holdings and proven project execution capabilities have experienced good gains and are still undervalued relative to their business outlook for the next 2-3 years.

These present medium- to long-term investment opportunities. Notable undervalued stocks with growth potential for 2025 include VHM of Vinhomes, NLG of Nam Long Group, KDH of Khang Dien House, and NTL of Tu Liem Urban Development JSC.

Investors should focus on companies with projects in favorable locations benefiting from public investment, a proven track record of executing projects, full legal status on most projects, high absorption rates for some ongoing sales, projected strong sales growth, safe financials, and attractive valuations relative to their growth potential in 2024 and 2025.

In the banking sector, Agriseco believes that many stocks are now attractively priced. Listed commercial banks have seen an average price increase of 23% since the beginning of the year, reflecting optimism about the macroeconomic outlook and the banking sector’s business prospects. Despite outperforming the VN-Index, the industry currently trades at an average P/B ratio of 1.5x, lower than the five-year average of 1.8x.

With strong growth prospects, Agriseco says banks deserve better valuations and that their stocks are currently in an attractive price range for investment. However, opportunities will not be equal across all banks. Those with higher credit quotas than the industry average, sustainable growth, strong capital buffers, and good asset quality are likely to have more favorable prospects.

Additionally, the anticipated market status upgrade in 2025 is expected to attract foreign interest, especially in blue-chip stocks like those in the banking sector.

After weaker performance in 2024, the oil and gas sector is now trading at a lower P/B ratio than its two-year average. Agriseco expects the sector to see better performance in 2025, driven by positive profit growth as major domestic oil and gas projects enter a more active phase. Additionally, the completion of the fifth maintenance round at the Dung Quat refinery in the central province of Quang Ngai in 2024 is expected to improve sector dynamics.

In the steel industry, Agriseco notes that the enforcement of public investment and real estate laws will likely boost steel demand in the coming period. Furthermore, if Vietnam imposes anti-dumping duties on hot-rolled coil (HRC) and galvanized steel, it will enhance the competitiveness of domestic steel, increasing market share for leading companies.

The anticipated market upgrade, coupled with current low valuations, will provide strong growth drivers for securities firms. Vietnam’s stock market is likely to attract a large influx of new investors, driving liquidity and increasing trading volumes.

This is a positive signal for securities companies’ business prospects. Moreover, the sector’s current P/B and P/E ratios are at average historical levels, presenting potential for price appreciation and opportunities for strategic investors, particularly foreign ones, to enter the market in 2025.

Banking & Finance

Life insurer FWD Vietnam fined for unfair competition

Published

1 year agoon

February 11, 2025FWD Vietnam Life Insurance Company Limited has been fined VND200 million ($7,975) for posting misleading information on its Facebook page, per a decision by the National Competition Commission (NCC) under the Ministry of Industry and Trade.

The headquarters of FWD Vietnam in Ho Chi Minh City, southern Vietnam. Photo courtesy of Cong thuong (Industry-Trade) newspaper.

According to the commission, FWD Vietnam was found to have misled customers with information about the company, its products, and services to attract customers from competitors.

This misinformation, posted on the company’s Facebook page, included statements such as “Number 1 brand for customer experience for four consecutive years in the life insurance industry in Vietnam”; “Insurance company with the fewest exclusions in the market”; “100% cashless payment with no paperwork”; “First insurance company distributing through e-commerce channels”; and “The most diverse and widespread distribution network in Vietnam.”

After reviewing the case, the NCC concluded that these actions violated Article 45 of the Law on Competition, which prohibits deceptive or misleading practices that could attract customers from other businesses.

However, the commission acknowledged that FWD Vietnam had proactively taken steps to mitigate the consequences of the violation, voluntarily reported the misconduct, and cooperated with the NCC in the investigation. This was also the first time the company had committed such a violation.

As a result, the NCC imposed an administrative fine of VND200 million ($7,975), the minimum level in the range subject to the violation (VND200-400 million) and ordered FWD Vietnam to publicly correct the misleading information on its Facebook page at https://www.facebook.com/BaohiemFWDVietnam/.

FWD Vietnam, under Asia-based Pacific Century Group, was licensed by the Ministry of Finance in 2016, with its headquarters located on the 11th floor of the Diamond Plaza building, 34 Le Duan street, Ben Nghe ward, District 1, Ho Chi Minh City.

It is known for its multi-channel distribution system, including bancassurance partnerships with major banks in Vietnam such as Agribank, Vietcombank, and HDBank.

On October 22, 2024, FWD Vietnam signed a partnership agreement with TC Advisors Joint Stock Company (TCA), making TCA the official distributor of its insurance products. Following the partnership, sales from this channel surged by nearly 500% year-on-year to VND90 billion ($3.6 million) in November 2024, and about 260% to VND75 billion in December 2024.

Banking & Finance

Major Vietnam private lender Techcombank intends to set up life insurance unit

Published

1 year agoon

February 11, 2025Techcombank, one of Vietnam’s major private lenders, is seeking shareholders’ approval to contribute capital for establishing a life insurance subsidiary regardless of a slowdown in the bancassurance sector.

The move came after Techcombank (HoSE: TCB) terminated a 15-year bancassurance partnership with Canada’s Manulife Vietnam in October 2024.

Life insurance sales in Vietnam have declined since the industry crisis in 2023. Bancassurance, once a key revenue stream for Techcombank, fell to VND606 billion ($24.15 million) in 2024, down from VND1.75 trillion ($69.75 million) in 2022.

A customer conducts transactions at a branch of Techcombank. Photo courtesy of the lender.

Following its separation from Manulife, Techcombank stated that it sees an opportunity to revitalize its insurance business with a differentiated strategy.

Additionally, Techcombank announced plans to seek shareholder approval to increase its stake in Techcom Nonlife Insurance JSC (TCGIns) beyond 11%, making it a subsidiary.

The Vietnamese life insurance sector’s premium revenue declined 5.5% year-on-year to VND132.2 trillion ($5.2 billion) in the first 11 months of 2024, according to the Ministry of Finance.

The local life insurance sector has experienced significant shifts over the past two years. The revised Insurance Business Law, effective from January 2023, and the finance ministry’s Circular 67, dated November 2, 2023, stipulates stricter regulations aimed at protecting policyholders’ rights.

Key changes include a ban on banks selling investment-linked insurance products within 60 days before or after a loan is disbursed and a requirement for insurance advisors to record consultations via audio or video.

The State Bank of Vietnam is also in the process of drafting Decree 88, which would impose administrative fines of VND400-500 million ($19,678) on banks found to link non-mandatory insurance products with their banking services.

Currently, there are 85 insurance companies operating in Vietnam, including 19 life insurers, with two domestic firms (Bao Viet and Bao Minh) and the remainder being foreign or joint-venture entities.

Bac Giang International Logistics Centre launched

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

Uncertainty weighing on real estate

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone