Companies

Private funding sought for renewables

Published

12 months agoon

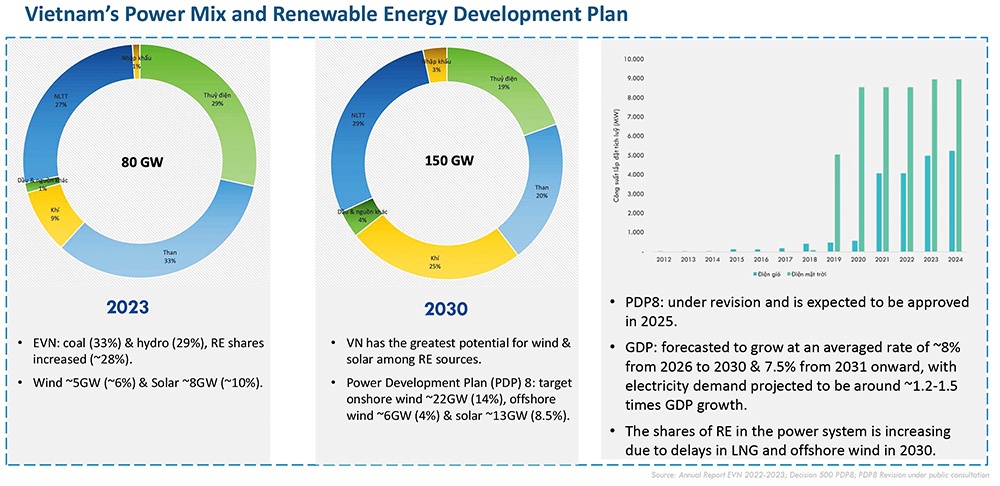

Reasonable electricity prices and a stable policy framework are deemed vital to attracting private sector investments in energy.

At a workshop on facilitating private sector access to and engagement in Vietnam’s energy sector in Hanoi in late February, former Deputy Chairman of the National Assembly Office Nguyen Si Dung said there was a high need for such funding.

Over the next decade, an average of $13.5 billion annually is needed, and that will likely extend to $20-26 billion towards 2050. Currently, the Ministry of Industry and Trade is adjusting this plan, with expectation that the capital demand will increase even more due to the development of nuclear power.

“We are facing many challenges, namely the lack of a competitive and transparent electricity price mechanism. Currently, the adjusted electricity price of the state does not fully reflect the cost, reducing the attractiveness of investors,” Dung said. “If the electricity price fails to be increased, the country will not be possible to encourage investment, but if we increase the electricity price, public opinion will be complicated. Therefore, there must be a clear communication strategy.”

According to Dung, access to capital for the private sector is a major issue as it will not be able to borrow, except for some large corporations. Private enterprises also face legal and policy risks. For example, land prices have increased up to six-fold, so it is not simple to engage businesses to invest in power transmission.

Phan Thanh Tung, general director of IPC Engineering and Construction JSC, said that the challenges to attracting private investments were not minor. Domestic and regional markets lack stability and consistency, and a roadmap for developing renewable energy as a foundation for investment in the supply chain.

“The domestic renewable energy market lacks connection and orientation between universities, colleges, and vocational schools with enterprises and manufacturing plants to provide workers with appropriate skills. At the same time, there is a lack of connection between domestic and foreign enterprises in the supporting industry for the renewable energy industry,” Tung said.

Most domestic enterprises are small or medium-sized, leading to a lack of competitive technological capacity and capital to meet investment in new technology and expansion, Tung added.

“There is a lack of specific policies on localising the supply chain to encourage domestic enterprises to invest and expand manufacturing facilities, and an absence of concrete incentive mechanisms for investment in wind power manufacturing and of attracting international suppliers to set up factories in Vietnam,” Tung said.

Dr. Le Xuan Nghia, a member of the National Monetary and Financial Policy Advisory Council, said energy demand far exceeded what was possible with a net-zero policy and renewable energy. Despite abundant wind and solar resources, energy efficiency is the most important determinant in the future.

“Vietnam needs to encourage private investment in all types of wind, solar, nuclear, coal and gas power. Energy saving itself is a form of renewable energy. Saving electricity and energy are important and effective short- and long-term solutions to reduce pressure on exploitation and ensure electricity supply,” he said.

Philip Timothy Rose, director of the Energy Transition Partnership, remarked that encouraging private sector engagement in energy development was critical.

“This is especially so, given that the total investment required for power development in Vietnam during 2021-2030 is projected to exceed $134 billion. Energy investments are private-sector-led, but government policies shape capital flows,” Rose said.

|

| Nguyen Thi Nhung, Assoc. Prof. University of Economics Vietnam National University

As Vietnam accelerates its energy transition, securing capital for renewables has become imperative. While the country is recalibrating financial policies to engage investment, mobilising sufficient funding remains a formidable challenge. Historically, banks have been the primary financiers of Vietnam’s energy sector, but renewable projects’ capital-intensive nature and long payback periods have strained credit availability. Regulatory constraints, including exposure limits under the Law on Credit Institutions, further restrict large-scale lending. Moreover, banks remain wary of market volatility and uncertainty, limiting appetites for renewable investments. Amid these constraints, companies are diversifying their capital structures, turning to corporate bonds and equity financing. Vietnam’s corporate bond market has expanded significantly since 2018, with green bonds emerging as a promising tool. However, the absence of a clear regulatory framework continues to hinder their development, leaving investors navigating uncertainty. Foreign investment remains an underutilised funding source. While major firms like Siemens Gamesa, Orsted, and JERA have injected capital into Vietnam’s renewables, foreign indirect investment lags due to the lack of sophisticated green financial instruments. Additionally, opaque electricity pricing and the absence of a clear framework for direct power purchase agreements deter institutional investors. A well-defined mechanism could unlock substantial international financing. Public-private partnerships are often cited as a solution, yet policy inconsistencies such as the abrupt shift from feed-in tariffs to competitive bidding raise investor concerns. Without a stable regulatory environment and a clear risk-sharing framework, they will struggle to gain some traction. Nguyen Tien Viet, Representative LSE Consulting The energy transition is a complex issue requiring multi-stakeholder collaboration, interdisciplinary integration, and a broad perspective. There is no single core sector that can independently address all the challenges. It is not merely a legal issue but also involves economic and infrastructure-related aspects. For instance, renewable energy development requires a much broader approach. Experts highlight that energy efficiency itself is a form of renewable energy, contributing to both conservation and sustainability. Renewable energy is not just about wind and solar power; it also involves energy storage and the expansion of infrastructure to optimise the use of these resources while addressing technical challenges and mitigating potential risks. The question is whether renewable energy can be considered truly viable without factoring in investment in storage solutions, grid infrastructure, and the overall support system. These are highly technical and critical aspects requiring input from experts across various fields. Furthermore, government involvement remains crucial in fostering partnerships and addressing Vietnam’s energy transition challenges. However, the government’s role should extend beyond regulatory oversight. It should also be a driving force in setting clear objectives to guide private capital investment. The private sector is highly dynamic and prioritises short-term economic benefits, whereas the government must take a long-term strategic role in managing risks and addressing overarching societal issues. Energy policy involves challenges that require both feasibility studies and sound decision-making frameworks. The development of sustainable and affordable energy sources is a delicate balance of three key factors: cost-effectiveness, supply stability, and environmental sustainability. These factors often conflict with one another, necessitating strategic policy direction aligned with Vietnam’s economic and social landscape. This requires leveraging international funding and advanced technology. |

You may like

Companies

Hanoi to renovate Hoan Kiem Lake area for park development

Published

12 months agoon

March 12, 2025The renovation project will involve extensive surveys to assess key architectural landmarks, historical sites, and cultural icons that warrant preservation.

|

| The commercial centre building, commonly known as the ‘Shark Jaw’ (Ham Ca Map) building, at Dong Kinh Nghia Thuc Square by Hoan Kiem Lake. (Photo: VNA) |

Hanoi – Vice Chairman of the Hanoi People’s Committee Duong Duc Tuan has requested a renovation plan for the eastern side of Hoan Kiem Lake, envisioning it as a special square and park zone.

The renovation project will involve extensive surveys to assess key architectural landmarks, historical sites, and cultural icons that warrant preservation. The aim is to propose new functions for the facilities to ensure they blend harmoniously with the area’s scenic landscape and historical significance.

On March 11, Tuan instructed the Department of Finance to swiftly establish a working group responsible for planning and revamping the Hoan Kiem Lake area, including the iconic Dong Kinh Nghia Thuc Square. It must draft a document on the investment policy for the special square and park zone and submit to the permanent members and the Standing Board of the municipal Party Committee by March 13, 2025.

To support the plan, the Department of Agriculture and Environment has been assigned to provide a detailed 1:500 scale topographic map of the area for the Hoan Kiem district People’s Committee and the Hanoi Urban Planning Institute. Additionally, the department will compile cadastral data to facilitate site clearance, compensation, and support mechanisms. Adjustments to land use plans should also be proposed to ensure seamless project implementation.

The project will also include a three-level underground space beneath the eastern side of Hoan Kiem Lake. This underground development will connect to the C9 station of the Nam Thang Long – Tran Hung Dao metro line. Measures will be taken to safeguard nearby heritage structures during the construction process, while functions for underground spaces will be proposed to optimise land use and meet public demand.

Tuan urged all departments to accelerate their proposals to execute the project. The development will unfold in two phases: the initial phase will involve the construction of the above-ground park and square using public investment, while the second phase will introduce underground facilities integrated with the C9 metro station following the Transit-Oriented Development (TOD) model.

To address the needs of displaced residents, the Department of Agriculture and Environment has been tasked with proposing maximum compensation policies. Eligible households will be offered resettlement land in the outlying district of Dong Anh. Meanwhile, resettlement housing will be sold to those not qualifying for land compensation.

In anticipation of resettlement demand, the city is fast-tracking a review of approximately 100ha of land in Dong Anh district to ensure sufficient space for resettlement efforts linked to this and other major development projects in Hanoi.

Companies

Zebra Technologies announces new strategy for 2025 in Vietnam

Published

12 months agoon

March 12, 2025Zebra Technologies Corporation, a global leader in digitising and automating frontline workers, is looking to expand in Vietnam by anchoring on an extensive network of partners, continued investment, and a comprehensive portfolio of solutions.

The company announced its 2025 strategy for Vietnam with the three pillars at its Regional Partner Summit 2025 held in Danang on March 5, underscoring its commitment to empowering partners and customers in Southeast Asia.

Talking to VIR at the event, Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC at Zebra Technologies, said, “We are seeing significant interest and opportunities for Vietnam to leapfrog in technology adoption. We are continuing to invest in enabling our customers in Vietnam to access the right solutions. That is our primary investment.”

|

| Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC. Photo: PV |

“We are continuously investing in training local Vietnamese partners on how to help customers digitise and automate. This is an ongoing investment. We conduct training sessions, provide demo units, and run proof-of-concept projects,” he added.

With a comprehensive portfolio of solutions, including everything from simple scanning devices to mobile computers, tablets, RFID, and machine vision, Zebra offers tailored solutions to meet the diverse needs of businesses in Vietnam to excel in a digital era.

Suryadarma noted, “Overall, our investments focus on strengthening our presence, expanding our capabilities, and enabling knowledge transfer. We equip our team and partners with the expertise they need so that when they engage with customers, they can offer well-prepared solutions.”

Zebra now has strong partners across Vietnam, as well as Vietnamese companies operating internationally. The company also has a repair and maintenance depot in Vietnam, where it has invested in training local workers.

Zebra opened its first service centre in Ho Chi Minh City in 2021. In 2022, Zebra expanded the centre to meet rising demand for printers, adding support for desktop, mobile, label, and industrial printers. Collaborating with distributors like SMC and Elite Technology, Zebra has developed a diverse partner ecosystem in Vietnam.

|

| Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC at Zebra Technologies. Photo: PV |

“Vietnam is a crucial market for Zebra. Our strong team and extensive certified partner network are dedicated to delivering industry-specific solutions to our customers,” said Suryadarma. “Leveraging our global expertise and innovative solutions, we aim to support all companies operating in Vietnam, across sectors like manufacturing, retail, transportation, logistics, and healthcare, to overcome challenges and achieve digital transformation.”

The 2025 strategy shows Zebra’s long-term commitments in Vietnam. According to Zebra Technologies, its strategy is deeply linked to megatrends – external factors that shape the tech industry. These include mobility and cloud, AI, digitalisation and the Internet of Things, e-commerce, and automation.

To continue offering a comprehensive portfolio of advanced solutions, innovation is at the heart of Zebra Technologies where it invests heavily in business development and research and development. Last year, the company’s revenue was approximately $5 billion, of which it allocated about 10 per cent towards innovation.

“Innovation allows us to continuously develop new technologies and solutions that address real-world challenges. By leveraging mobility, cloud computing, scanning, RFID, and other technologies, we can provide real-time tracking and insights to meet the growing business demands of optimising workflows, improving efficiency, and enhancing decision-making,” the Zebra representative noted. “Our goal is to seamlessly connect all these elements – assets, people, and activities – through enterprise mobile computing. The more we can connect frontline workers, the better we can enhance business operations.”

Commitment to innovation has positioned Zebra Technologies as the leader in rugged mobile computing. While consumer mobile computing – laptops and smartphones – is widely used, Zebra dominates the enterprise mobile computing space, particularly in rugged devices designed for business-critical operations.

Another area where the company is very strong is data capture. Today is the era of AI. But for AI to work effectively, it needs data—clean, accurate data. As the company specialises in data capture, it is in a strong position to align with AI-driven market trends.

Along with data capture, the company is also the leader in barcode printing. Many businesses need barcode labels. These labels are used in countless industries. In Vietnam, for example, it’s becoming common in restaurants where instead of taking orders manually, customers simply scan a barcode on the table to access the menu.

Another area where Zebra holds the number one position is mobile RFID. RFID stands for radio frequency identification. This is a fast-growing business, and today, the world consumes approximately 30 billion RFID tags annually.

Key industry trends for 2025

Manufacturing, transport and logistics, and retail are the areas where Zebra is deeply involved.

Suryadarma said that manufacturing is a major industry in Vietnam. Zebra’s machine vision and AI solutions can significantly enhance manufacturing operations. He sees a lot of potential in helping businesses improve efficiency and productivity through automation and smart technology.

“We recognise the trends in this sector. Now, we are seeing many economic uncertainties, trade discussions, and shifting policies that are prompting manufacturers to focus on incremental, scalable improvements rather than sweeping transformations. Manufacturers want to automate their processes, but they are looking for cost-effective modernisation strategies. This requires new approaches and scalable automation tools for success,” he admitted.

|

| Zebra Technologies’ 2025 Regional Partner Summit in Danang. Photo: PV |

In transport and logistics, companies are now balancing onshore and offshore solutions while also ensuring sustainability. They would rather not generate excessive waste; instead, they want to reduce carbon footprints and implement greener supply chain practices. This shift requires greater visibility and real-time insights.

In logistics, the market sees a growing interest in AI, RFID, real-time tracking, and new visibility technologies. These are becoming increasingly important. For example, Vietnamese company Nhat Tin Logistics has implemented Zebra’s scanning solutions, improving speed, efficiency, and productivity in scanning and delivery operations.

Moving on to retail, customer expectations and labour shortages are two major challenges in this industry. This is where technology is making an impact.

“With Vietnam’s large population, retail is booming. We’re seeing a lot of automation in retail. For example, many cafés now use digital solutions – customers scan a QR code, place orders, and receive their items seamlessly. Many retailers have already adopted RFID to enhance customer experience. While we cannot disclose specific names due to customer confidentiality, we can confirm that RFID adoption is happening in Vietnam,” he added.

An example is in warehouses. When people walk into a warehouse, they do not just see shelves of products, they see workers constantly moving, picking, sorting, and delivering items. These workers are the backbone of warehouse operations. Similarly, in hospitals, nurses and doctors are on the front line, caring for patients and ensuring smooth medical operations.

|

| Many regional partners joined the summit. Photo: PV |

Healthcare is another key area of growth. Similar to other countries, people in Vietnam increasingly expect better healthcare services, both from government and private hospitals. Digitalisation plays a crucial role in improving healthcare efficiency.

“With nearly 8 per cent GDP growth last year, the challenge now is how to push Vietnam’s growth even further. Maybe one day, Vietnam can reach 10 per cent or even higher. It is not impossible, but it comes down to the people, the partnerships, and strong leadership across all organisations,” he noted.

Vietnam is to work with the United States on ways to reach a trade balance and circumvent the latter’s heavy tariff imposition.

|

| Vietnam is improving local products and origin of goods information, photo Le Toan |

Later this week, Minister of Industry and Trade Nguyen Hong Dien will fly to the US to work with its Department of Commerce on further materialising the comprehensive strategic partnership forged in 2023.

“The main reason for the trade imbalance between the two countries comes from the complementary nature of the two economies, which is due to the export and foreign trade structure of the two countries,” said Deputy Minister of Industry and Trade Nguyen Sinh Nhat Tan at last week’s governmental press conference in Hanoi.

“Vietnamese exports to the US compete with those from third nations, not directly with US enterprises in the US market. Meanwhile, they even also create conditions for American consumers to use Vietnamese goods at cheap prices,” Tan added.

According to the Ministry of Industry and Trade (MoIT), Vietnam is an open economy which pursues a free trade policy. The tariff difference on US goods is not high and may decrease in the future because Vietnam will reduce most favoured nation tariffs on many types of goods.

“Therefore, a number of US products with high competitive advantages such as automobiles, agricultural products, liquefied natural gas, and ethanol will benefit from this policy,” Tan said. “At the same time, it will create positive import flows from the US, contributing to improving the trade balance between the two.”

In addition, there is an ongoing policy dialogue on trade and investment between the two countries under the Vietnam-US Trade and Investment Framework Agreement founded in 2007. Therefore, existing problems in bilateral trade and economy, if any, will be proactively discussed through the US-Vietnam Council on Trade and Investment.

This is a mechanism that has created a common vision, contributed to the long-term direction, and stabilised the development of bilateral economic and trade relations, the MoIT said.

In addition, the Vietnamese government has taken the initiative in assigning ministries and sectors to review obstacles to the US “on the basis of fair trade, reciprocity, in accordance with the law, harmoniously and satisfactorily meeting the interests of all parties”, the ministry added.

“Vietnam will also create better conditions for US investors to participate in the process of forming and developing key industries in Vietnam, especially key energy projects involving new energy, hydrogen, and nuclear power,” Tan explained. “This will create a premise to increase imports of liquefied natural gas, fuel, machinery and equipment, and technology from the US, thereby contributing to improving the trade balance between the two countries.”

Via the US Embassy to Vietnam and the country’s counterpart in the US, the MoIT has sent a message that Vietnam wishes to maintain and develop a harmonious and sustainable economic and trade relationship of mutual benefits with the US. At the same time, Vietnam reaffirmed that it has and will never create any policy that hurts labourers or the national security of the US.

Since returning to office in January, US President Donald Trump has launched a sweeping series of tariffs, marking a return to the aggressive trade policies of his first term. The measures reflect the administration’s broader effort to protect domestic industries and address what the president views as unfair trade practices.

According to Asia Briefing, a subsidiary of Dezan Shira & Associates, as a major supplier of goods to the US, the tariffs could significantly impact Vietnamese exporters.

“It is also possible that Vietnam will become the target of country-specific tariffs, as the country has a large trade surplus with the US and has previously been accused by the US administration of engaging in unfair trade practices,” Asia Briefing said. “However, Vietnam may be able to mitigate the impact by striking a deal with the US, especially if it agrees to increase imports of American goods or ease market access for businesses from the US.”

However, Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, told VIR that it was too early to gauge the impact of tariffs. In the past month, Vietnamese officials have repeatedly said they would seek compromises with the US on trade.

“This is likely to include promises of additional aeroplane purchases, boosting Vietnam’s imports from the US of liquefied natural gas, better market access for American agricultural products, and an adjustment of some regulations to make it easier for US companies to access the Vietnamese market,” Sitkoff said.

He suggested that Vietnam should take some necessary actions, including creation of more transparency in the origin of goods and increasing local content, and doing more to solve burdens and barriers faced by American companies and investors here.

Vietnam’s exports to the US reached $119.6 billion last year and $19 billion in the first two months of 2025.

Bac Giang International Logistics Centre launched

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

Uncertainty weighing on real estate

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone