Banking & Finance

Foreign funds charmed by Vietnamese stocks

Published

12 months agoon

After a stellar 2024, foreign funds continue to show optimism about the growth of the Vietnamese stock market in 2025.

VN-Index closed 2024 at 1,266.78 points, up 12.1% against the beginning of the year. Photo by The Investor/Trong Hieu.

Impressive performance in 2024

Foreign funds investing in Vietnamese stocks had a successful 2024, with impressive performance figures. A notable example is VinaCapital’s VinaCapital Modern Economy Equity Fund (VMEEF), which posted a return of 27.45%.

Other VinaCapital funds also showed positive results, including VinaCapital Equity Opportunity Fund (+18.69%), VinaCapital Equity Special Access Fund (+17.51%), and VinaCapital Insights Balanced Fund (+14.63%).

Apart from VinaCapital funds, there were Dragon Capital’s Dynamic Securities Fund (+19.78%) and DC Dividend Focus Equity Fund (+13.97%). Similarly, another major player, Pyn Elite Fund from Finland, reported a return of 21.79%.

Vietnam’s stock market lauded

Le Anh Tuan, chief investment officer at Dragon Capital, believed that the current valuation of Vietnam’s stock market does not fully reflect the potential for its status upgrade. The price-to-book ratio of the VN-Index for 2025 is projected to be at its lowest level in the past 10 years so the market’s valuation is quite attractive, he noted.

The Dragon Capital executive also forecast a 70% chance that the market will have its status upgraded from “frontier” to “emerging” in March 2025. Among the nine criteria for a status upgrade set by Russell, Vietnam has yet to meet two criteria: clearing and settlement, and the DvP (delivery versus payment) cycle, he said, adding he is optimistic that the new trading system KRX, with its clearing and settlement system, will make progress in 2025.

“With high expectations for growth and movements in the economy, a strong investment cycle is gradually becoming evident,” Tuan said.

Meanwhile, Pyn Elite Fund maintains its long-term view that the VN-Index could reach 2,500 points. In 2021, the Finnish fund projected that the index would reach 2,500 points, but after four years, the main index has still not touched that level.

Pyn Elite Fund stated that this outlook is based on good profit growth in the coming years and a market P/E (price-to-earnings) ratio of 16. The fund also predicted that this ratio will drop to 10.1 by 2025, as profits of listed stocks in Vietnam continue to grow.

Forecasting the stock market capitalization will be equivalent to 57% of GDP by 2025, the fund even believed that in a growing economy, the figure could reach nearly 100%.

Michael Kokalari, chief economist at VinaCapital, assessed that concerns over tariffs under the new U.S. President Donald Trump, combined with slower export and GDP growth, could affect the VN-Index and the value of the VND in the first half of 2025.

However, in the second half, Vietnam’s GDP growth is expected to accelerate if the Government implements strong measures to support the economy, and the pressure on the VND/USD exchange rate could ease, along with diminishing concerns about President Trump’s impact on Vietnam, he noted.

VinaCapital views the decline in the stock market as an opportunity to buy stocks, especially since the market’s valuation remains attractive with a projected P/E ratio of 12x, compared to a projected EPS (earnings per share) growth of 17%.

Additionally, the fund expects foreign capital to return to the Vietnamese stock market in 2025 when there is clear information that President Donald Trump’s tariff policy will not target Vietnam.

You may like

-

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

-

Uncertainty weighing on real estate

-

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone

-

Green engagement rides high in Vietnam

-

New standards being reached within green industrial parks

-

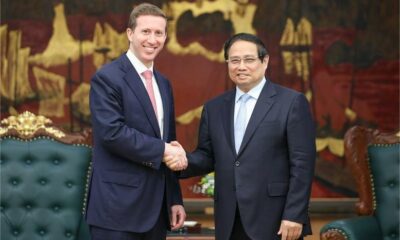

Vietnam PM asks Warburg Pincus to invest ‘further and faster’

Banking & Finance

VN-Index to hit 1,450 points in H2: broker

Published

12 months agoon

February 11, 2025Companies listed on the Ho Chi Minh City Stock Exchange (HoSE) are projected to see an average 18-20% profit growth in 2025, and its benchmark index, the VN-Index, will reach approximately 1,450 points in the second half, according to Agribank Securities (Agriseco).

Vietnam is currently one of the stock markets with the lowest P/E ratio in the region. Photo by The Investor/Trong Hieu.

Last Friday, the last trading day before the Lunar New Year holiday, the VN-Index rose over 5 points to 1,265.

According to Agriseco, the index is currently trading at a price-to-earnings (P/E) ratio of around 13 times and a price-to-book (P/B) ratio of 1.7 times, both of which are below the market’s five-year averages of 14.5 times and 2.0 times, respectively. Notably, the P/B ratio is at its lowest level in the past five years.

Given the current P/E ratio, Agriseco believes that the VN-Index is one of the most undervalued markets in the region. Additionally, Vietnam’s market shows a higher return on equity (RoE) compared to the regional average, indicating that Vietnam’s stock market is relatively attractively valued.

Agriseco is optimistic about the market’s prospects for 2025, with strong economic growth and robust corporate earnings expected to drive performance. Furthermore, the anticipated upgrade by FTSE Russell from a frontier market to an emerging in 2025 is likely to attract both foreign and domestic investors.

The market is expected to see an influx of $5-6 billion from exchange-traded funds (ETFs) tracking FTSE indices and active funds then. Such an event will likely increase the number of foreign investors in Vietnam, benefiting securities firms such as Saigon Securities (SSI), Ho Chi Minh City Securities (HCM), and Viet Capital Securities (VCI), which manage a significant portion of foreign accounts.

Large-cap stocks such as Vietcombank (VCB), Vinhomes (VHM), FPT, and Hoa Phat Group (HPG) are expected to be in focus as foreign capital flows into the market.

Stock opportunities

Agriseco highlights real estate as a potential opportunity. Currently, the real estate sector is trading at a P/B ratio of 1.2x, which is lower than the five-year average of 2.4x. Since the beginning of 2024, the group has lagged behind the VN-Index, with prices continuing to decline.

The most significant declines have been seen in small-cap stocks with poor earnings and high leverage. However, companies with strong land holdings and proven project execution capabilities have experienced good gains and are still undervalued relative to their business outlook for the next 2-3 years.

These present medium- to long-term investment opportunities. Notable undervalued stocks with growth potential for 2025 include VHM of Vinhomes, NLG of Nam Long Group, KDH of Khang Dien House, and NTL of Tu Liem Urban Development JSC.

Investors should focus on companies with projects in favorable locations benefiting from public investment, a proven track record of executing projects, full legal status on most projects, high absorption rates for some ongoing sales, projected strong sales growth, safe financials, and attractive valuations relative to their growth potential in 2024 and 2025.

In the banking sector, Agriseco believes that many stocks are now attractively priced. Listed commercial banks have seen an average price increase of 23% since the beginning of the year, reflecting optimism about the macroeconomic outlook and the banking sector’s business prospects. Despite outperforming the VN-Index, the industry currently trades at an average P/B ratio of 1.5x, lower than the five-year average of 1.8x.

With strong growth prospects, Agriseco says banks deserve better valuations and that their stocks are currently in an attractive price range for investment. However, opportunities will not be equal across all banks. Those with higher credit quotas than the industry average, sustainable growth, strong capital buffers, and good asset quality are likely to have more favorable prospects.

Additionally, the anticipated market status upgrade in 2025 is expected to attract foreign interest, especially in blue-chip stocks like those in the banking sector.

After weaker performance in 2024, the oil and gas sector is now trading at a lower P/B ratio than its two-year average. Agriseco expects the sector to see better performance in 2025, driven by positive profit growth as major domestic oil and gas projects enter a more active phase. Additionally, the completion of the fifth maintenance round at the Dung Quat refinery in the central province of Quang Ngai in 2024 is expected to improve sector dynamics.

In the steel industry, Agriseco notes that the enforcement of public investment and real estate laws will likely boost steel demand in the coming period. Furthermore, if Vietnam imposes anti-dumping duties on hot-rolled coil (HRC) and galvanized steel, it will enhance the competitiveness of domestic steel, increasing market share for leading companies.

The anticipated market upgrade, coupled with current low valuations, will provide strong growth drivers for securities firms. Vietnam’s stock market is likely to attract a large influx of new investors, driving liquidity and increasing trading volumes.

This is a positive signal for securities companies’ business prospects. Moreover, the sector’s current P/B and P/E ratios are at average historical levels, presenting potential for price appreciation and opportunities for strategic investors, particularly foreign ones, to enter the market in 2025.

Banking & Finance

Life insurer FWD Vietnam fined for unfair competition

Published

12 months agoon

February 11, 2025FWD Vietnam Life Insurance Company Limited has been fined VND200 million ($7,975) for posting misleading information on its Facebook page, per a decision by the National Competition Commission (NCC) under the Ministry of Industry and Trade.

The headquarters of FWD Vietnam in Ho Chi Minh City, southern Vietnam. Photo courtesy of Cong thuong (Industry-Trade) newspaper.

According to the commission, FWD Vietnam was found to have misled customers with information about the company, its products, and services to attract customers from competitors.

This misinformation, posted on the company’s Facebook page, included statements such as “Number 1 brand for customer experience for four consecutive years in the life insurance industry in Vietnam”; “Insurance company with the fewest exclusions in the market”; “100% cashless payment with no paperwork”; “First insurance company distributing through e-commerce channels”; and “The most diverse and widespread distribution network in Vietnam.”

After reviewing the case, the NCC concluded that these actions violated Article 45 of the Law on Competition, which prohibits deceptive or misleading practices that could attract customers from other businesses.

However, the commission acknowledged that FWD Vietnam had proactively taken steps to mitigate the consequences of the violation, voluntarily reported the misconduct, and cooperated with the NCC in the investigation. This was also the first time the company had committed such a violation.

As a result, the NCC imposed an administrative fine of VND200 million ($7,975), the minimum level in the range subject to the violation (VND200-400 million) and ordered FWD Vietnam to publicly correct the misleading information on its Facebook page at https://www.facebook.com/BaohiemFWDVietnam/.

FWD Vietnam, under Asia-based Pacific Century Group, was licensed by the Ministry of Finance in 2016, with its headquarters located on the 11th floor of the Diamond Plaza building, 34 Le Duan street, Ben Nghe ward, District 1, Ho Chi Minh City.

It is known for its multi-channel distribution system, including bancassurance partnerships with major banks in Vietnam such as Agribank, Vietcombank, and HDBank.

On October 22, 2024, FWD Vietnam signed a partnership agreement with TC Advisors Joint Stock Company (TCA), making TCA the official distributor of its insurance products. Following the partnership, sales from this channel surged by nearly 500% year-on-year to VND90 billion ($3.6 million) in November 2024, and about 260% to VND75 billion in December 2024.

Banking & Finance

Major Vietnam private lender Techcombank intends to set up life insurance unit

Published

12 months agoon

February 11, 2025Techcombank, one of Vietnam’s major private lenders, is seeking shareholders’ approval to contribute capital for establishing a life insurance subsidiary regardless of a slowdown in the bancassurance sector.

The move came after Techcombank (HoSE: TCB) terminated a 15-year bancassurance partnership with Canada’s Manulife Vietnam in October 2024.

Life insurance sales in Vietnam have declined since the industry crisis in 2023. Bancassurance, once a key revenue stream for Techcombank, fell to VND606 billion ($24.15 million) in 2024, down from VND1.75 trillion ($69.75 million) in 2022.

A customer conducts transactions at a branch of Techcombank. Photo courtesy of the lender.

Following its separation from Manulife, Techcombank stated that it sees an opportunity to revitalize its insurance business with a differentiated strategy.

Additionally, Techcombank announced plans to seek shareholder approval to increase its stake in Techcom Nonlife Insurance JSC (TCGIns) beyond 11%, making it a subsidiary.

The Vietnamese life insurance sector’s premium revenue declined 5.5% year-on-year to VND132.2 trillion ($5.2 billion) in the first 11 months of 2024, according to the Ministry of Finance.

The local life insurance sector has experienced significant shifts over the past two years. The revised Insurance Business Law, effective from January 2023, and the finance ministry’s Circular 67, dated November 2, 2023, stipulates stricter regulations aimed at protecting policyholders’ rights.

Key changes include a ban on banks selling investment-linked insurance products within 60 days before or after a loan is disbursed and a requirement for insurance advisors to record consultations via audio or video.

The State Bank of Vietnam is also in the process of drafting Decree 88, which would impose administrative fines of VND400-500 million ($19,678) on banks found to link non-mandatory insurance products with their banking services.

Currently, there are 85 insurance companies operating in Vietnam, including 19 life insurers, with two domestic firms (Bao Viet and Bao Minh) and the remainder being foreign or joint-venture entities.

Bac Giang International Logistics Centre launched

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

Uncertainty weighing on real estate

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone