Companies

European medicine standards growing presence in Vietnam

Published

12 months agoon

Following a year of strategic expansion, European medicine-related companies are advancing their operations in Vietnam. Gregoris Charitonos, chairman of the European Standards Medicines Sector Committee under the European Chamber of Commerce in Vietnam, talked to VIR’s Tung Anh about what lies ahead.

How have legal changes made impacts on the performance of member companies of your sector committee in Vietnam?

|

| Gregoris Charitonos, chairman of the European Standards Medicines Sector Committee under the European Chamber of Commerce in Vietnam |

Member companies demonstrated resilience and adaptability in a rapidly evolving business landscape in 2024. Despite global economic uncertainties, our member companies have achieved significant growth, driven by strong demand for high-quality European pharmaceutical products. Key highlights include regulatory progress, expansion and market penetration, investment in local capabilities, and sustainability initiatives.

Several member companies successfully obtained new product registrations, ensuring a more diverse portfolio of standard European medicines available to Vietnamese patients. Throughout the law drafting process, we have sent position papers to the relevant authorities to raise the voice of the off-patent pharmaceuticals industry.

Thanks to our continued effort, the amended pharma law is expected to help simplify the dossier for extension and variation registration from 2025, which will improve patient access to high quality generic medicines reducing public healthcare burden.

Many of our member companies expanded their presence in Vietnam, strengthening partnerships with local distributors, hospitals, and pharmacies.

Increased investments in research, clinical trials, and digital transformation have enhanced operational efficiency and patient accessibility. In 2023, we sponsored the Drug Administration of Vietnam during a two-day symposium on bioequivalence and clinical data evaluation in Hanoi, for evaluators, professors, and company members to address the current difficulties in dossier assessment and together come up with solutions.

Last month, we also co-held a conference on enhancing capacity of experts in evaluation of bioequivalence dossiers, at the University of Pharmacy and Medicines in Ho Chi Minh City, together with Sapharcen and Saigon Pharmaceutical Science Technology Centre.

Member companies place a strong emphasis on sustainability in line with the global sustainability goals. For example, they have incorporated environmentally friendly packaging and implemented green supply chain strategies.

Vietnam has taken commendable steps to improve its business environment, with notable progress in streamlining administrative procedures, digitalising regulatory processes, and enhancing transparency in pharmaceutical regulations. These efforts have facilitated faster market access for European medicines and improved the overall ease of doing business.

However, some challenges remain. Specifically, in regulatory consistency, while improvements have been made, unpredictable changes in regulations can still cause delays in product registration and market access. As one of the suggestions would be to use reliance with the European Medicines Agency.

Regarding pricing and reimbursement policies, further clarity and predictability in pricing policies would benefit member companies and ensure continued patient access to high-quality medicines.

Moreover, lengthy administrative processes, such as those in EU GMP publishing, by eliminating redundant approvals for documents that have been legally issued and authenticated. Specifically, once a document is issued and legalised, it should be accepted without further re-approval, as currently it may negatively impact supply to the hospital.

Also, government pharmaceutical policies evolve to treat generic medicines as equal to innovator molecules. While current policies largely emphasise innovator molecules, there is a pressing need to introduce measures that support and promote high-quality generic products. By ensuring that regulatory frameworks, funding, and quality assurance standards are equally applied to both categories, we can foster a competitive market that improves accessibility, affordability, and innovation across the healthcare sector.

Member companies expect greater harmonisation with international standards, faster approvals for new registrations, and a more predictable regulatory framework to sustain long-term growth, less unnecessary administrative procedures and equal policy treatment of the innovative and generic molecules. We will continue to advocate for the draft circular and decree guiding the amended Pharmaceutical Law, which is now open for comments.

Digital transformation and green growth are high on the agenda in the pharmaceutical industry. What are the priorities member companies give in this twin transition?

Our member companies have been actively implementing digital transformation and green growth initiatives in Vietnam, ensuring sustainable and efficient operations.

Key initiatives include e-prescriptions and telemedicine, AI and big data in pharma and smart distribution. In particular, many companies are collaborating with hospitals to integrate digital prescriptions and telehealth services, enhancing patient access to medicines.

AI-driven research, digital supply chains, and predictive analytics are improving efficiency and decision-making. Meanwhile, automated warehouse management and digital tracking systems are enhancing supply chain transparency and minimising waste.

In regard to green growth, several companies have introduced sustainable packaging solutions, reducing plastic waste and carbon footprints.

Members are also investing in green energy solutions, carbon offset programmes, and eco-friendly production facilities to align with global sustainability standards.

Value-added medicines, or so-called combo medicines, of our members not only improve the patients’ compliance and improve patients’ access to innovative therapies, but significantly limit waste, therefore have a great positive impact in terms of decreasing the environment pollution. On the other hand, companies implement sustainable waste disposal and recycling programmes within pharmaceutical operations.

Digitalisation and sustainability are no longer optional but essential for future growth, and member companies remain committed to these initiatives.

In business and investment among member companies in Vietnam, what will be their driving forces?

Vietnam’s pharmaceutical market is one of the most dynamic and competitive in Southeast Asia, with strong local and international players. While domestic pharmaceutical companies are expanding their capabilities, European pharmaceutical products continue to be highly valued for their quality, safety, and efficacy.

Vietnam’s market is growing rapidly, but regulatory approval times are still longer compared to Singapore and Malaysia, where procedures are more standardised. The country’s strategic location, fast-growing economy, and strong government focus on healthcare development make it an increasingly attractive market for long-term pharmaceutical investment. While competition is intense, Vietnam’s potential as a leading pharmaceutical hub in Southeast Asia remains strong, provided regulatory improvements continue.

Looking ahead to 2025 and beyond, member companies are highly optimistic about Vietnam’s long-term potential. More companies are expanding clinical research and trial capabilities in Vietnam, aligning with global standards. However, for a real kick-off in research and development, tax incentives and grants for life science in Vietnam are required. There is also a growing focus on biologic drugs, vaccines, and innovative therapies, addressing unmet medical needs.

While Vietnam is not yet a major pharmaceutical manufacturing hub, interest in local partnerships and technology transfers is increasing. This should be reflected in governmental actions, facilitating investments in pharmaceutical manufacturing and supporting export opportunities.

Public-private partnerships will continue to play a crucial role in healthcare policy development and accessibility improvements. Some companies are relocating or expanding operations in Vietnam due to its favourable investment climate, compared to markets with stricter price controls or regulatory hurdles.

Vietnam is positioned as a key pharmaceutical growth market in Southeast Asia, and our member companies will continue to drive innovation, sustainability, and patient-centric healthcare solutions in the country to have better patent access for high-quality generic medicines.

You may like

-

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

-

Uncertainty weighing on real estate

-

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone

-

Green engagement rides high in Vietnam

-

New standards being reached within green industrial parks

-

Vietnam PM asks Warburg Pincus to invest ‘further and faster’

Companies

Hanoi to renovate Hoan Kiem Lake area for park development

Published

12 months agoon

March 12, 2025The renovation project will involve extensive surveys to assess key architectural landmarks, historical sites, and cultural icons that warrant preservation.

|

| The commercial centre building, commonly known as the ‘Shark Jaw’ (Ham Ca Map) building, at Dong Kinh Nghia Thuc Square by Hoan Kiem Lake. (Photo: VNA) |

Hanoi – Vice Chairman of the Hanoi People’s Committee Duong Duc Tuan has requested a renovation plan for the eastern side of Hoan Kiem Lake, envisioning it as a special square and park zone.

The renovation project will involve extensive surveys to assess key architectural landmarks, historical sites, and cultural icons that warrant preservation. The aim is to propose new functions for the facilities to ensure they blend harmoniously with the area’s scenic landscape and historical significance.

On March 11, Tuan instructed the Department of Finance to swiftly establish a working group responsible for planning and revamping the Hoan Kiem Lake area, including the iconic Dong Kinh Nghia Thuc Square. It must draft a document on the investment policy for the special square and park zone and submit to the permanent members and the Standing Board of the municipal Party Committee by March 13, 2025.

To support the plan, the Department of Agriculture and Environment has been assigned to provide a detailed 1:500 scale topographic map of the area for the Hoan Kiem district People’s Committee and the Hanoi Urban Planning Institute. Additionally, the department will compile cadastral data to facilitate site clearance, compensation, and support mechanisms. Adjustments to land use plans should also be proposed to ensure seamless project implementation.

The project will also include a three-level underground space beneath the eastern side of Hoan Kiem Lake. This underground development will connect to the C9 station of the Nam Thang Long – Tran Hung Dao metro line. Measures will be taken to safeguard nearby heritage structures during the construction process, while functions for underground spaces will be proposed to optimise land use and meet public demand.

Tuan urged all departments to accelerate their proposals to execute the project. The development will unfold in two phases: the initial phase will involve the construction of the above-ground park and square using public investment, while the second phase will introduce underground facilities integrated with the C9 metro station following the Transit-Oriented Development (TOD) model.

To address the needs of displaced residents, the Department of Agriculture and Environment has been tasked with proposing maximum compensation policies. Eligible households will be offered resettlement land in the outlying district of Dong Anh. Meanwhile, resettlement housing will be sold to those not qualifying for land compensation.

In anticipation of resettlement demand, the city is fast-tracking a review of approximately 100ha of land in Dong Anh district to ensure sufficient space for resettlement efforts linked to this and other major development projects in Hanoi.

Companies

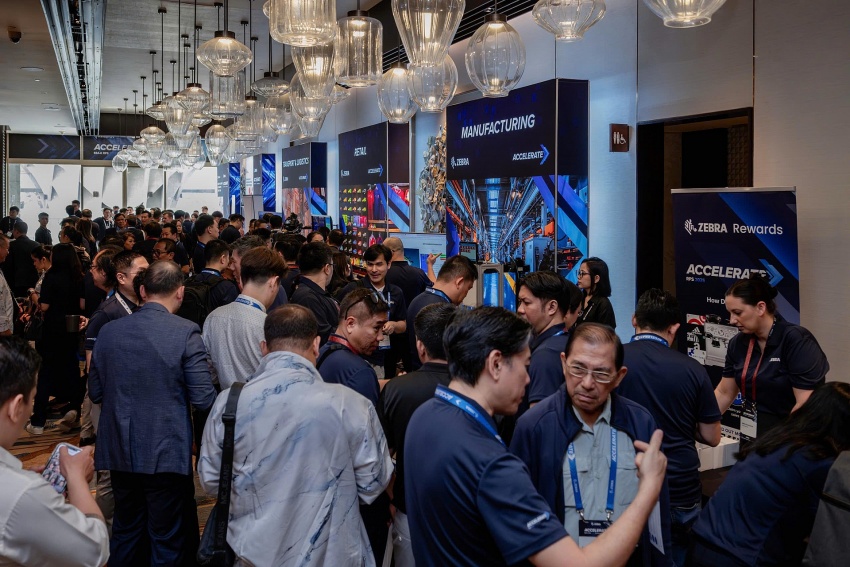

Zebra Technologies announces new strategy for 2025 in Vietnam

Published

12 months agoon

March 12, 2025Zebra Technologies Corporation, a global leader in digitising and automating frontline workers, is looking to expand in Vietnam by anchoring on an extensive network of partners, continued investment, and a comprehensive portfolio of solutions.

The company announced its 2025 strategy for Vietnam with the three pillars at its Regional Partner Summit 2025 held in Danang on March 5, underscoring its commitment to empowering partners and customers in Southeast Asia.

Talking to VIR at the event, Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC at Zebra Technologies, said, “We are seeing significant interest and opportunities for Vietnam to leapfrog in technology adoption. We are continuing to invest in enabling our customers in Vietnam to access the right solutions. That is our primary investment.”

|

| Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC. Photo: PV |

“We are continuously investing in training local Vietnamese partners on how to help customers digitise and automate. This is an ongoing investment. We conduct training sessions, provide demo units, and run proof-of-concept projects,” he added.

With a comprehensive portfolio of solutions, including everything from simple scanning devices to mobile computers, tablets, RFID, and machine vision, Zebra offers tailored solutions to meet the diverse needs of businesses in Vietnam to excel in a digital era.

Suryadarma noted, “Overall, our investments focus on strengthening our presence, expanding our capabilities, and enabling knowledge transfer. We equip our team and partners with the expertise they need so that when they engage with customers, they can offer well-prepared solutions.”

Zebra now has strong partners across Vietnam, as well as Vietnamese companies operating internationally. The company also has a repair and maintenance depot in Vietnam, where it has invested in training local workers.

Zebra opened its first service centre in Ho Chi Minh City in 2021. In 2022, Zebra expanded the centre to meet rising demand for printers, adding support for desktop, mobile, label, and industrial printers. Collaborating with distributors like SMC and Elite Technology, Zebra has developed a diverse partner ecosystem in Vietnam.

|

| Christanto Suryadarma, sales vice president for Southeast Asia, South Korea, and Channel APJeC at Zebra Technologies. Photo: PV |

“Vietnam is a crucial market for Zebra. Our strong team and extensive certified partner network are dedicated to delivering industry-specific solutions to our customers,” said Suryadarma. “Leveraging our global expertise and innovative solutions, we aim to support all companies operating in Vietnam, across sectors like manufacturing, retail, transportation, logistics, and healthcare, to overcome challenges and achieve digital transformation.”

The 2025 strategy shows Zebra’s long-term commitments in Vietnam. According to Zebra Technologies, its strategy is deeply linked to megatrends – external factors that shape the tech industry. These include mobility and cloud, AI, digitalisation and the Internet of Things, e-commerce, and automation.

To continue offering a comprehensive portfolio of advanced solutions, innovation is at the heart of Zebra Technologies where it invests heavily in business development and research and development. Last year, the company’s revenue was approximately $5 billion, of which it allocated about 10 per cent towards innovation.

“Innovation allows us to continuously develop new technologies and solutions that address real-world challenges. By leveraging mobility, cloud computing, scanning, RFID, and other technologies, we can provide real-time tracking and insights to meet the growing business demands of optimising workflows, improving efficiency, and enhancing decision-making,” the Zebra representative noted. “Our goal is to seamlessly connect all these elements – assets, people, and activities – through enterprise mobile computing. The more we can connect frontline workers, the better we can enhance business operations.”

Commitment to innovation has positioned Zebra Technologies as the leader in rugged mobile computing. While consumer mobile computing – laptops and smartphones – is widely used, Zebra dominates the enterprise mobile computing space, particularly in rugged devices designed for business-critical operations.

Another area where the company is very strong is data capture. Today is the era of AI. But for AI to work effectively, it needs data—clean, accurate data. As the company specialises in data capture, it is in a strong position to align with AI-driven market trends.

Along with data capture, the company is also the leader in barcode printing. Many businesses need barcode labels. These labels are used in countless industries. In Vietnam, for example, it’s becoming common in restaurants where instead of taking orders manually, customers simply scan a barcode on the table to access the menu.

Another area where Zebra holds the number one position is mobile RFID. RFID stands for radio frequency identification. This is a fast-growing business, and today, the world consumes approximately 30 billion RFID tags annually.

Key industry trends for 2025

Manufacturing, transport and logistics, and retail are the areas where Zebra is deeply involved.

Suryadarma said that manufacturing is a major industry in Vietnam. Zebra’s machine vision and AI solutions can significantly enhance manufacturing operations. He sees a lot of potential in helping businesses improve efficiency and productivity through automation and smart technology.

“We recognise the trends in this sector. Now, we are seeing many economic uncertainties, trade discussions, and shifting policies that are prompting manufacturers to focus on incremental, scalable improvements rather than sweeping transformations. Manufacturers want to automate their processes, but they are looking for cost-effective modernisation strategies. This requires new approaches and scalable automation tools for success,” he admitted.

|

| Zebra Technologies’ 2025 Regional Partner Summit in Danang. Photo: PV |

In transport and logistics, companies are now balancing onshore and offshore solutions while also ensuring sustainability. They would rather not generate excessive waste; instead, they want to reduce carbon footprints and implement greener supply chain practices. This shift requires greater visibility and real-time insights.

In logistics, the market sees a growing interest in AI, RFID, real-time tracking, and new visibility technologies. These are becoming increasingly important. For example, Vietnamese company Nhat Tin Logistics has implemented Zebra’s scanning solutions, improving speed, efficiency, and productivity in scanning and delivery operations.

Moving on to retail, customer expectations and labour shortages are two major challenges in this industry. This is where technology is making an impact.

“With Vietnam’s large population, retail is booming. We’re seeing a lot of automation in retail. For example, many cafés now use digital solutions – customers scan a QR code, place orders, and receive their items seamlessly. Many retailers have already adopted RFID to enhance customer experience. While we cannot disclose specific names due to customer confidentiality, we can confirm that RFID adoption is happening in Vietnam,” he added.

An example is in warehouses. When people walk into a warehouse, they do not just see shelves of products, they see workers constantly moving, picking, sorting, and delivering items. These workers are the backbone of warehouse operations. Similarly, in hospitals, nurses and doctors are on the front line, caring for patients and ensuring smooth medical operations.

|

| Many regional partners joined the summit. Photo: PV |

Healthcare is another key area of growth. Similar to other countries, people in Vietnam increasingly expect better healthcare services, both from government and private hospitals. Digitalisation plays a crucial role in improving healthcare efficiency.

“With nearly 8 per cent GDP growth last year, the challenge now is how to push Vietnam’s growth even further. Maybe one day, Vietnam can reach 10 per cent or even higher. It is not impossible, but it comes down to the people, the partnerships, and strong leadership across all organisations,” he noted.

Vietnam is to work with the United States on ways to reach a trade balance and circumvent the latter’s heavy tariff imposition.

|

| Vietnam is improving local products and origin of goods information, photo Le Toan |

Later this week, Minister of Industry and Trade Nguyen Hong Dien will fly to the US to work with its Department of Commerce on further materialising the comprehensive strategic partnership forged in 2023.

“The main reason for the trade imbalance between the two countries comes from the complementary nature of the two economies, which is due to the export and foreign trade structure of the two countries,” said Deputy Minister of Industry and Trade Nguyen Sinh Nhat Tan at last week’s governmental press conference in Hanoi.

“Vietnamese exports to the US compete with those from third nations, not directly with US enterprises in the US market. Meanwhile, they even also create conditions for American consumers to use Vietnamese goods at cheap prices,” Tan added.

According to the Ministry of Industry and Trade (MoIT), Vietnam is an open economy which pursues a free trade policy. The tariff difference on US goods is not high and may decrease in the future because Vietnam will reduce most favoured nation tariffs on many types of goods.

“Therefore, a number of US products with high competitive advantages such as automobiles, agricultural products, liquefied natural gas, and ethanol will benefit from this policy,” Tan said. “At the same time, it will create positive import flows from the US, contributing to improving the trade balance between the two.”

In addition, there is an ongoing policy dialogue on trade and investment between the two countries under the Vietnam-US Trade and Investment Framework Agreement founded in 2007. Therefore, existing problems in bilateral trade and economy, if any, will be proactively discussed through the US-Vietnam Council on Trade and Investment.

This is a mechanism that has created a common vision, contributed to the long-term direction, and stabilised the development of bilateral economic and trade relations, the MoIT said.

In addition, the Vietnamese government has taken the initiative in assigning ministries and sectors to review obstacles to the US “on the basis of fair trade, reciprocity, in accordance with the law, harmoniously and satisfactorily meeting the interests of all parties”, the ministry added.

“Vietnam will also create better conditions for US investors to participate in the process of forming and developing key industries in Vietnam, especially key energy projects involving new energy, hydrogen, and nuclear power,” Tan explained. “This will create a premise to increase imports of liquefied natural gas, fuel, machinery and equipment, and technology from the US, thereby contributing to improving the trade balance between the two countries.”

Via the US Embassy to Vietnam and the country’s counterpart in the US, the MoIT has sent a message that Vietnam wishes to maintain and develop a harmonious and sustainable economic and trade relationship of mutual benefits with the US. At the same time, Vietnam reaffirmed that it has and will never create any policy that hurts labourers or the national security of the US.

Since returning to office in January, US President Donald Trump has launched a sweeping series of tariffs, marking a return to the aggressive trade policies of his first term. The measures reflect the administration’s broader effort to protect domestic industries and address what the president views as unfair trade practices.

According to Asia Briefing, a subsidiary of Dezan Shira & Associates, as a major supplier of goods to the US, the tariffs could significantly impact Vietnamese exporters.

“It is also possible that Vietnam will become the target of country-specific tariffs, as the country has a large trade surplus with the US and has previously been accused by the US administration of engaging in unfair trade practices,” Asia Briefing said. “However, Vietnam may be able to mitigate the impact by striking a deal with the US, especially if it agrees to increase imports of American goods or ease market access for businesses from the US.”

However, Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, told VIR that it was too early to gauge the impact of tariffs. In the past month, Vietnamese officials have repeatedly said they would seek compromises with the US on trade.

“This is likely to include promises of additional aeroplane purchases, boosting Vietnam’s imports from the US of liquefied natural gas, better market access for American agricultural products, and an adjustment of some regulations to make it easier for US companies to access the Vietnamese market,” Sitkoff said.

He suggested that Vietnam should take some necessary actions, including creation of more transparency in the origin of goods and increasing local content, and doing more to solve burdens and barriers faced by American companies and investors here.

Vietnam’s exports to the US reached $119.6 billion last year and $19 billion in the first two months of 2025.

Bac Giang International Logistics Centre launched

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

Uncertainty weighing on real estate

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone