Activities

A Landmark Year for Dang Thanh Tam: $1.5 Billion Deal with Trump Organization and Nearly $3.2 Billion Industrial Park Investments

Published

1 year agoon

Dang Thanh Tam’s enterprises are expected to thrive as Vietnam attracts a surge in foreign direct investment (FDI).

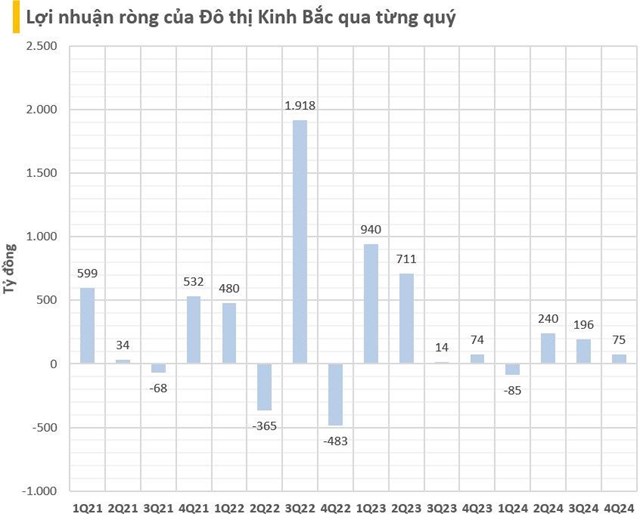

A Milestone Year for the Chairman of Kinh Bac City Development Holding Corporation (KBC)

The year 2024 is significant for Dang Thanh Tam, Chairman of KBC, as he celebrates his 60th birthday and achieves remarkable business milestones.

A major highlight is successfully bringing The Trump Organization—owned by the family of newly elected U.S. President Donald Trump—to invest in Vietnam.

On September 25, 2024, The Trump Organization and Hung Yen Hospitality Services JSC—a subsidiary of KBC—announced a partnership to develop a luxury complex in Vietnam. The $1.5 billion project will include a five-star hotel, an international-standard golf course, a high-end residential area, and premium facilities.

The project features a VVIP 54-hole golf course, luxury resorts, and exclusive villas designed for high-level summits and special events. Additionally, a separate 54-hole golf course and modern urban development will support the region’s rapid economic growth, positioning Hung Yen Province to become a centrally governed city in the near future.

A Track Record of Attracting Global Giants

This landmark deal continues Dang Thanh Tam’s legacy of securing investments from multinational corporations. Before The Trump Organization, KBC successfully attracted major global investors, including Foxconn, LG, Goertek, and Canon, to its industrial parks.

Born in 1964, Dang Thanh Tam graduated with a degree in engineering from the Vietnam Maritime University in Hai Phong. He also holds degrees in law, business administration, and a Diploma of Business Management from Henley Business School, UK.

From 1988 to 1996, he worked at Saigon Shipping Company before becoming CEO of Tan Tao Investment & Industry Corporation in 1997. His success in developing the Tan Tao Industrial Park during the Asian financial crisis cemented his reputation as a pioneer in Vietnam’s industrial real estate sector.

In 2007, he became the richest person on Vietnam’s stock market, holding assets worth VND 6.3 trillion ($270 million) after the successful listing of Tan Tao Investment & Industry Corporation (ITA).

Currently, he serves as Chairman of several listed companies, including KBC and Saigontel. He holds over 138.6 million KBC shares, 10 million SGT shares, and more than 29 million ITA shares, with an estimated total net worth of VND 4.4 trillion ($188 million).

Kinh Bac City: A Powerhouse in Industrial Real Estate

Founded in 2002, Kinh Bac City specializes in industrial park development, urban projects, and infrastructure investments. The company is a dominant force in Vietnam’s industrial real estate sector, controlling 6,611 hectares of land—accounting for 5.1% of the country’s industrial land.

Over 90% of tenants in KBC’s high-tech industrial parks are major foreign corporations from Japan, Taiwan, South Korea, and China, including Canon, Foxconn, LG, and Ingrasys.

KBC’s key industrial parks include:

- Tan Phu Trung (Ho Chi Minh City) – 590 ha

- Que Vo (Bac Ninh) – 600 ha

- Nam Son Hap Linh (Bac Ninh) – 402 ha

- Quang Chau (Bac Giang) – 426 ha

- Dai Dong Hoan Son (Bac Ninh) – 400 ha

- Trang Due (Hai Phong) – 600 ha

- Phuong Nam (Quang Ninh) – 569 ha

In addition to industrial zones, KBC holds 1,413.3 hectares of urban development land across major provinces and 117.7 hectares allocated for manufacturing facilities.

Expanding Portfolio: $3.2 Billion in New Projects

KBC continues to generate billions in revenue annually, with industrial real estate leasing contributing the largest share.

At the start of 2025, Hai Phong authorities granted investment registration certificates for two major KBC projects:

- Trang Cat Urban & Services Area Project

- Developer: Trang Cat Urban Development Co., a KBC subsidiary

- Investment capital increase: VND 62.7 trillion ($2.7 billion), bringing total project investment to VND 69.1 trillion ($3 billion)

- Located in Trang Cat Ward, Hai An District, within the Dinh Vu-Cat Hai Economic Zone

- Approved master plan since 2010, spanning 584.94 hectares

- Trang Due 3 Industrial Park Infrastructure Project

- Developer: Saigon-Hai Phong Industrial Park JSC (SHP), a KBC subsidiary

- Investment: VND 8.09 trillion ($330 million)

- Total area: 652.73 hectares

- Located in Truong Tho, Truong Thanh, An Tien, and Bat Trang communes, An Lao District

These projects, despite facing delays, are expected to drive significant revenue growth for KBC in the coming years.

Looking Ahead

With Vietnam emerging as a prime destination for FDI, Dang Thanh Tam’s strategic investments and global partnerships solidify KBC’s position as a leading industrial real estate developer. His ability to attract world-class investors like The Trump Organization underscores his vision and influence in shaping Vietnam’s economic landscape.

Activities

HoREA Proposes Allowing Businesses to Build Worker Housing Inside Industrial Parks

Published

11 months agoon

March 31, 2025The Ho Chi Minh City Real Estate Association (HoREA) has proposed a pilot mechanism that would allow businesses to invest in and construct worker housing within industrial parks.

In a document submitted to the Prime Minister, contributing feedback on a draft pilot policy aimed at boosting social housing development, HoREA suggested that businesses, cooperatives, and cooperative unions operating within industrial parks be permitted to build accommodation for their workers. It also called for allowing companies to rent housing outside industrial parks for the same purpose.

HoREA emphasized that all costs related to building or renting worker housing should be recognized as legitimate business expenses and be included in the enterprise’s operating costs.

The association further recommended expanding the policy framework to allow companies within industrial parks to lease social housing or worker accommodation built by third-party developers outside the park premises.

According to Mr. Lê Hoàng Châu, Chairman of HoREA, the current Housing Law (2023) only allows companies to rent worker housing inside industrial parks, without clearly defining whether they can rent social housing outside the parks or construct such housing themselves.

With worker housing demand at industrial parks far exceeding supply, HoREA pointed out that current social housing and dormitory offerings are inadequate. Meanwhile, commercial housing remains out of reach for most workers due to high prices. Therefore, the association urges the government to introduce policies enabling manufacturing businesses—despite not operating in real estate—to develop their own accommodation solutions for employees.

HoREA underscored that such policies would create a strong legal foundation, empowering enterprises and cooperatives to proactively resolve housing issues for workers. If allowed to construct their own housing, companies could ensure homes go to those in need, boosting employee retention, improving living standards, and supporting sustainable growth in industrial zones.

The association also proposed financial support mechanisms, including tax incentives, access to preferential loans, or government-matching support, to reduce the financial burden on companies participating in worker housing development.

Previously, many businesses had expressed a desire to buy land, build housing, and offer installment-based homeownership plans to workers, whereby employees would pay monthly through salary deductions. While this model helps workers secure long-term housing, legal procedures remain a major hurdle.

Providing accommodation has increasingly become part of corporate strategies to retain labor, alongside other employee welfare policies. For example, Nissei Electric Vietnam (Linh Trung 1 Export Processing Zone, Thu Duc City) has built a dormitory complex with 285 shared rooms, housing up to 2,280 workers. Eternal Prowess Vietnam (District 12) and Thien Phat Company (Linh Trung 2 EPZ) have also invested in on-site worker housing. Thien Phat’s project includes 368 units (35m² each), rented at VND 2.2 million/month, with 80% of the units for families and 20% for shared accommodations.

As of Q2 2024, Ho Chi Minh City has 18 industrial parks with around 1,700 businesses employing approximately 320,000 workers. Citywide, over 1.3 million people are employed in factories. However, there are only 16 official worker housing complexes, accommodating about 22,000 people. The majority of workers rely on rented rooms or stay with acquaintances—often sharing 12m² rooms among 2–3 people, which consumes 15–20% of their monthly income.

From 2021 to the present, Ho Chi Minh City has completed six social housing projects with 2,700 units and is building four more with 3,000 units. By April 30, the city aims to resolve legal hurdles and break ground on 5–6 additional social housing projects, totaling around 8,000 units.

Activities

Vietnam’s leading developer Becamex IDC targets $825 mln from ‘historic’ share offering

Published

1 year agoon

February 11, 2025Becamex IDC Corp, a leading eco-industrial and urban real estate developer in Vietnam, plans to raise nearly VND20.88 trillion ($825 million) from a public offering of 300 million shares on the Ho Chi Minh Stock Exchange (HoSE), equivalent to its current equity.

An industrial park developed by Becamex IDC. Photo courtesy of the company.

The corporation has approved the starting price of VND69,593 ($2.75) for the public auction of its BCM shares on the HoSE, aiming for VND20.88 trillion, nearly 40% higher than the initial expected value.

This offering is considered the largest since the state-owned capital divestment boom from 2016 to 2018.

The offering price is almost five times the book value of the stock at the consolidated financial statement for Q4/2024 and the average of the last 30 trading sessions prior to February 6, 2025 on the HoSE.

At the end of 2024, the company’s charter capital was VND10.35 trillion ($408.93 million), and equity was VND20.48 trillion ($809.2 million). If the capital raising is successful, its charter capital will increase to VND13.35 trillion, and equity will double to over VND41 trillion.

Becamex IDC, a giant in the industrial real estate sector in the southern province of Binh Duong, seeks to raise funds to invest in projects such as the Cay Truong Industrial Park and the expanded Bau Bang Industrial Park, as well as to contribute capital to existing companies, including Vietnam-Singapore Industrial Park J.V. Co. Ltd. (VSIP), Becamex Binh Phuoc Infrastructure Development JSC, Becamex VSIP Power Investment and Development JSC (BVP), Vietnam-Singapore Smart Energy Solutions JSC (VSSES), and Becamex Binh Dinh JSC. It also plans to restructure its finances.

Currently, the largest shareholder of the company is the People’s Committee of Binh Duong province, with a 95.44% stake. If the auction is successful, the state’s ownership will drop to 74%.

In the stock market, BCM moved counter to the VN-Index, steadily declining from VND87,000 ($3.44) per share at the end of 2022 to VND51,000 per share in April 2024. However, while the VN-Index stagnated, the ticker rebounded and closed at VND70,000 per share on Friday, up 37.2%.

The stock’s growth momentum slowed in the last quarter of the previous year due to a decline in business results. Specifically, in Q4/2024, Becamex IDC reported a sharp 60% decrease in revenue to VND2 trillion ($79 million).

Despite joint venture activities doubling profits to VND1.19 trillion, its after-tax profit still decreased by 33% to VND1.37 trillion ($54.13 million). For the whole year, its net revenue fell by 35% to VND5.2 trillion, and net profit dropped 12.5% to VND2.1 trillion.

Expansion ambition from 2024 to 2028

The corporation mainly operates in the fields of industrial park infrastructure investment, urban development, services, and trade. It is the developer of six industrial parks in Binh Duong province, covering a total land area of 2,931 hectares with an occupancy rate of 88%. The firm is also finalizing legal procedures to put the 700-hectare Cay Truong Industrial Park into operation in 2025.

In addition, Becamex IDC has expanded its reach to other localities outside Binh Duong, such as Binh Phuoc, Tay Ninh, Khanh Hoa, Quang Ngai, Thua Thien-Hue, Thanh Hoa, Nam Dinh, Ninh Binh and Hai Duong provinces, and Hai Phong city. The firm has also received in-principle approvals for four more industrial parks in Lang Son, Thai Binh, Binh Thuan, and Ha Tinh provinces.

Besides industrial parks, Becamex IDC has also developed urban and service areas such as the My Phuoc Residential Area, Thoi Hoa Residential Area, and Bau Bang Residential Area. The corporation plans to allocate resources for high-impact commercial projects like the WTC Exhibition Center, WTC Tower, and WTC Gateway cultural-central station complex in New Binh Duong town.

Moreover, the company, together with Singapore’s Sembcorp Industries, has developed the Vietnam-Singapore Industrial Park (VSIP) model, featuring an innovation center in an industrial-urban-service complex including a business incubator, advanced manufacturing center, and renewable energy research center.

These strategies will be implemented from 2024 to 2028, with a vision towards 2030. To achieve these goals, the company plans to increase its charter capital if necessary, borrow from credit institutions, and issue bonds.

Becamex IDC currently has total liabilities of VND38.3 trillion ($1.51 billion), with short-term debt of VND7.9 trillion and long-term debt of VND15.72 trillion. Its debt-to-equity ratio is 1.1 times.

Activities

Japan-invested solar cell maker Vietnam Sunergy to start $30 mln plant from June

Published

1 year agoon

February 11, 2025Japan-invested Vietnam Sunergy Wafer, a manufacturer of solar cells, plans to start official production at its $30 million factory in Hung Yen province from June.

The firm aims to complete administrative procedures in May and then install equipment in June, according to a recent project report. The plant covers 2.65 hectares in Minh Quang Industrial Park of the northern province.

A factory of Vietnam Sunergy JSC. Photo courtesy of VSUN Solar Vietnam.

The project has an annual capacity of 600 million silicon wafers, a component of solar cells, equivalent to 9,375 tons. It is set to employ 1,000 people.

Hung Yen recorded registered foreign direct investment (FDI) of $1.5 billion in 71 projects in 2024, the highest-ever figure in terms of capital, according to provincial data.

The province, a neighbor of Hanoi, has so far attracted FDI of $8.5 billion. It now has 17 industrial parks in its masterplan, covering 4,395 hectares. Of these, 10 facilities are now operational.

Bac Giang International Logistics Centre launched

Vietnam’s Exclusive Economic Zone boasts over 1,000 GW of wind power potential: report

Uncertainty weighing on real estate

Central Vietnam city seeks $1.84 bln for 15 projects in economic zone