To mark this milestone, a series of events will showcase the strong bonds between both nations in trade, education, and sustainability. Key activities include two gala concerts, the German Festival in Hanoi and Ho Chi Minh City, the Career Truck showcasing opportunities for Vietnamese talent in Germany, and a Climate Talks panel on the future of the Mekong Delta.

|

| Peter Kompalla, chief representative for Vietnam, Cambodia, Myanmar, and Laos Delegation of German Industry and Commerce |

These initiatives reflect not only cultural and educational ties but also the economic potential for further investment and collaboration.

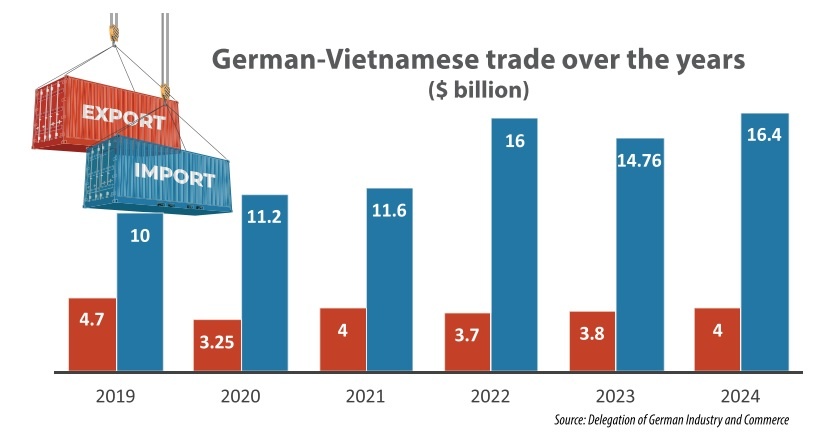

Today, Germany stands as Vietnam’s largest European trade partner, while Vietnam has become a thriving hub for German businesses in ASEAN. Trade remains a cornerstone of German-Vietnamese economic relations: according to preliminary 2024 data from Destatis, trade between the two countries grew by 9.6 per cent, reaching €18.8 billion ($20.4 billion).

German exports to Vietnam increased by 5.6 per cent (€3.7 billion or $4 billion), while imports surged by 10.7 per cent (€15.1 billion or $16.4 billion). This underscores Vietnam’s role as a key supplier and manufacturing hub for German firms.

Vietnam has become a key hub in global supply chains, with particularly interesting developments in manufacturing, renewable energy, and digital services. German businesses benefit from its strategic ASEAN location, free trade agreements, and highly motivated workforce. With tax incentives, improved infrastructure, and streamlined regulations, Vietnam continues to attract more foreign investment, solidifying its role as a prime destination for German enterprises.

As German companies further optimise and diversify their supply chains, Vietnam stands out as a business partner. Its strong economic growth, expanding industries, and commitment to sustainability make it increasingly attractive.

Forecasts for 2025 are reinforcing its position as one of Asia’s fastest-growing economies. A young, skilled workforce further enhances Vietnam’s appeal, offering businesses a dynamic and cost-effective labour market.

Vietnam’s digital transformation is driving investment, with its digital economy set to contribute 25 per cent of GDP soon. Government efforts in digital infrastructure, e-commerce, and cashless payments support this growth, with e-commerce projected to hit $63 billion by 2030.

High-tech manufacturing, including semiconductors and automotive production, is expanding alongside major infrastructure projects like metro systems, the North-South high-speed railway, and Long Thanh International Airport.

Meanwhile, Vietnam’s sustainability drive, from solar to offshore wind, aligns with German environmental, social, and governance priorities. With strong economic fundamentals and a thriving digital sector, Vietnam remains a prime destination for German investors.

Germany is also driving digitalisation and Industry 4.0 in Vietnam, with Bosch Rexroth, Beckhoff, SEW Eurodrive, Trumpf, and Würth leading in automation and the Internet of Things. Companies like Baumer and Fibro see Vietnam’s potential in precision engineering, supporting its transformation into a high-tech manufacturing hub.

This knowledge exchange will be highlighted at our symposium in May on Vietnamese factory automation and German efforts, where industry leaders will discuss the future of smart production.

Sustainability remains a key pillar of German investment, with firms embracing initiatives in renewable energy, waste management, and sustainable agriculture. PNE AG’s Hon Trau nearshore wind power project in the south-central province of Binh Dinh exemplifies Germany’s commitment to Vietnam’s green transition, supporting the country’s Power Development Plan VIII.

Equally important is workforce development, where German enterprises actively collaborate with Vietnamese vocational institutions to bridge skill gaps. The Career Truck’s journey across Vietnam, complemented by the flagship Career Day events in Hanoi and Ho Chi Minh City, will serve as a dynamic platform to showcase education and employment pathways. This initiative underscores Germany’s continued commitment to enhancing Vietnam’s skilled labour force and fostering long-term career opportunities.

Ho Chi Minh City and Hanoi serve as economic hubs, attracting German investments in finance, IT, and consulting. Meanwhile, the southern provinces of Binh Duong and Dong Nai have become manufacturing strongholds, hosting major German companies in the automotive, chemicals, and also electronics industries.

Beyond these traditional sectors, areas such as logistics, pharmaceuticals, and IT services are experiencing rapid growth, further drawing German investment into Vietnam’s evolving market.

As the official representative of the German industry in Vietnam, we continue to support businesses in market entry, expansion, and networking through trade fairs and business delegations. The next 50 years promise deeper collaboration, enhanced sustainability efforts, and continued economic success for both nations.

By leveraging this momentum, German and Vietnamese businesses can drive mutual prosperity and innovation well into the future.

Activities4 months ago

Activities4 months ago

Activities4 months ago

Activities4 months ago

Infrastructure2 months ago

Infrastructure2 months ago

Project2 months ago

Project2 months ago

Project2 months ago

Project2 months ago

Project2 months ago

Project2 months ago

Activities2 months ago

Activities2 months ago

Activities2 months ago

Activities2 months ago